Get the free pdffiller

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

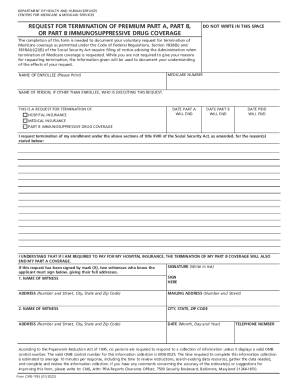

How to fill out a DHS 20 verification of form form

Understanding the DHS 20 verification of assets form

The DHS 20 verification of form is a crucial document used to assess an individual's assets, ensuring that they are eligible for various public assistance programs. It's essential for applicants to understand the significance and implications of submitting this form accurately.

-

This form helps the Department of Human Services verify asset information. Accurate completion contributes to fair assessment and assistance eligibility.

-

Individuals applying for or currently receiving public assistance, such as food assistance or Medicaid, are typically required to submit the DHS 20 form.

-

Failing to submit this verification can lead to delayed benefits or denial of assistance, impacting the applicant's financial situation.

How do complete the DHS 20 form?

Completing the DHS 20 form involves several steps that require careful attention to detail. Below is a guide to help you fill out each section correctly.

-

Begin with personal information, followed by asset declaration. Ensure that all fields are filled out accurately to avoid confusion.

-

Double-check your entries, especially financial figures, as errors can lead to penalties.

-

Use precise values from bank statements and other official documents to ensure compliance with the asset verification process.

How can pdfFiller help with completing the DHS 20 form?

pdfFiller offers various interactive tools designed to simplify the form-filling process. Utilizing these features can enhance both the accuracy and efficiency of your submission.

-

pdfFiller’s editing functionalities allow you to fill out, save, and modify your document easily, making corrections as needed.

-

Using eSignature helps validate your form submission electronically, ensuring that it is processed without unnecessary delays.

-

For teams, pdfFiller allows collaborative editing, ensuring that all necessary stakeholders can contribute to the completion of the form.

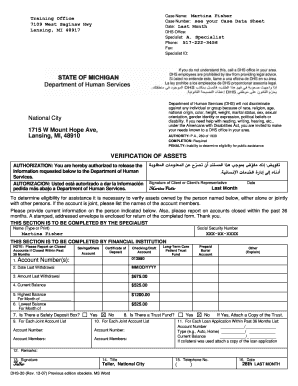

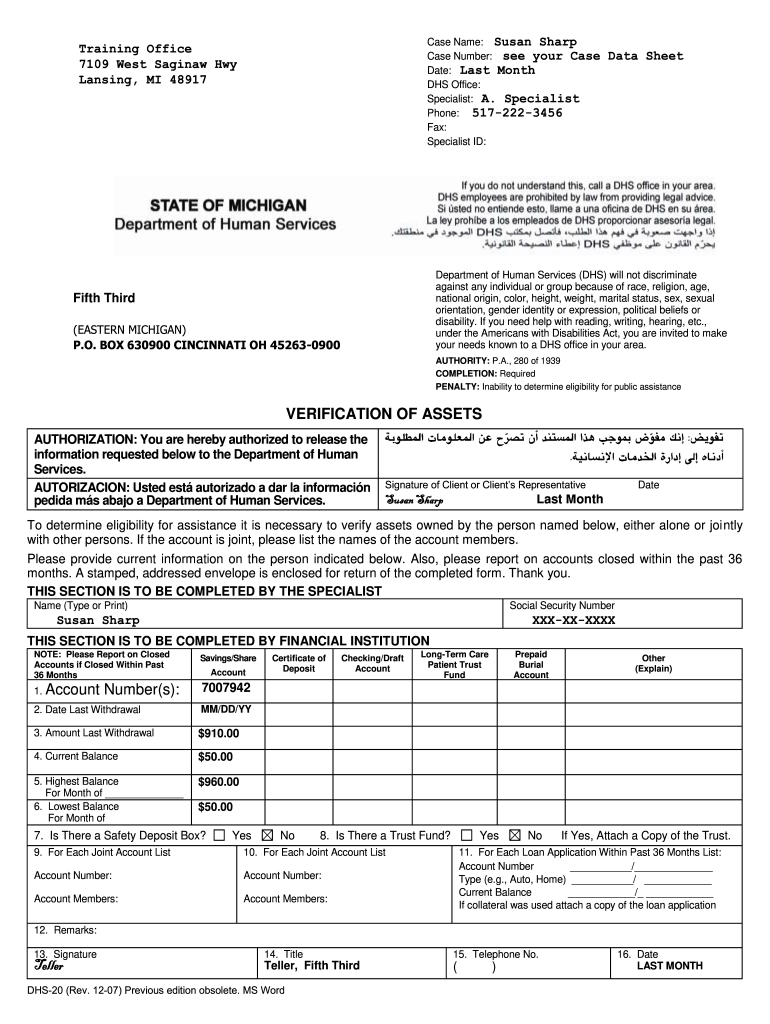

What are the essential sections of the DHS 20 form?

The DHS 20 form consists of several critical sections that require careful attention to detail. Understanding these sections is vital for accurate completion and submission.

-

These identifiers help the processing agency link the form to your application, so ensure they are filled out accurately.

-

This section requires a detailed account of your financial resources, such as bank accounts, real estate, and other assets.

-

By signing this section, you grant permission for the DHS to verify the information provided, reinforcing the form’s legitimacy.

What should Michigan residents know about DHS 20 compliance?

In Michigan, there are specific regulations and guidelines that govern the submission of the DHS 20 form. Being aware of these aspects can facilitate a smoother application process.

-

Michigan may have unique requirements that differ from other states, so reviewing these before submission is crucial.

-

Be aware of laws that protect applicants from discrimination based on various factors, ensuring a fair review process.

-

Utilize local DHS resources for personalized assistance with completing and submitting your form.

How do submit the DHS 20 form?

Submitting the DHS 20 form can be done through multiple methods, ensuring convenience for all applicants. Understanding your options can help in timely submission.

-

You can submit your form in person, by mail, or through online platforms. Each method has specific steps, so choose what works best for you.

-

Always attach necessary documents such as proof of income or identification to verify your claims during the review process.

-

Processing times may vary, but understanding these can help you better plan your application and follow-ups.

What are the consequences of improper submission?

Submitting the DHS 20 form incorrectly or late can result in penalties that may affect your eligibility for assistance. Understanding these repercussions is essential for applicants.

-

Incorrect or late submissions can lead to fines, loss of benefits, and a possibility of disqualification from public assistance programs.

-

Failure to comply with asset verification can directly impact your eligibility for much-needed public assistance.

-

If errors arise post-submission, prompt corrective action will limit potential penalties and restore eligibility.

Frequently Asked Questions about dhs 20 verification of assets form

What happens if I miss the submission deadline for the DHS 20 form?

Missing the deadline can lead to a delay or denial of your benefits. It's essential to submit all required documentation on time to ensure uninterrupted assistance.

Do I need to submit supporting documents with my DHS 20 form?

Yes, you may need to include proof of income and other financial documents to support your asset claims. These ensure that your application is processed smoothly.

Can I update my DHS 20 form after submission?

You can request updates or corrections if you realize there are errors after submission. It's best to contact the relevant agency promptly to correct these issues.

Is there an online version of the DHS 20 form?

Yes, the DHS 20 form is often available online for easy access. You can use pdfFiller for an interactive filling experience directly from your device.

How does pdfFiller make the DHS 20 form easier to complete?

pdfFiller streamlines the process with editing tools, eSignatures, and collaborative features, making form completion efficient whether you're working alone or with a team.

pdfFiller scores top ratings on review platforms